Colombia's Petro proposes tax reform to fund 2026 budget

Colombian President Gustavo Petro's government has introduced a new tax reform bill in Congress to cover the $6.3 billion shortfall in the 2026 budget.

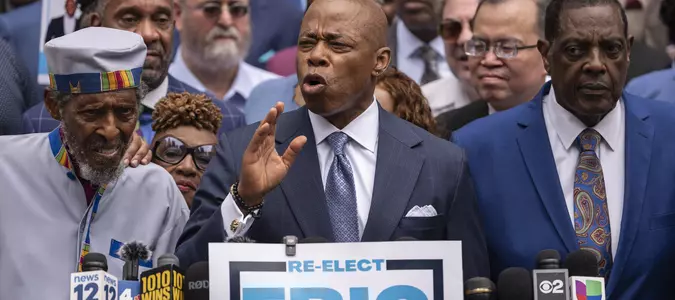

The latest Colombia tea reform initiative faces strong opposition in Congress and has become the center of a political battle over fiscal sustainability, public security and the finances of millions of Colombians. Photo by caruizp/Pixabay UPI

Sept. 5 (UPI) -- Colombian President Gustavo Petro's government has introduced a new tax reform bill in Congress to cover the $6.3 billion shortfall in the 2026 budget. It is the third tax reform of his administration and is intended to secure the $139 billion the state says it needs next year.

In 2022, Petro introduced his first tax reform, which was approved and raised $2.7 billion. In 2024, however, Congress rejected a similar proposal seeking $3 billion, leaving the 2025 budget unfunded and forcing the executive branch to issue it by decree.

The initiative, presented Sept. 1 by Finance Minister Germán Ávila, faces strong opposition in Congress and has become the center of a political battle over fiscal sustainability, public security and the finances of millions of Colombians.

The bill calls for higher taxes on high-income individuals and wealth, along with new levies on fuel, liquor and gambling. It would also tax foreign companies that provide digital services such as Netflix, Amazon Prime and HBO.

Petro contends the bill seeks greater equity and will not affect the middle class or the poor, but will instead target the "mega rich."

However, opposition leaders have rejected the measure, calling it poorly timed and harmful to the economy.

They argue that higher fuel taxes would raise food prices, directly affecting household budgets. They also criticize the government for imposing new burdens on citizens instead of cutting public spending.

On one of the most criticized points of the reform, Óscar Darío Pérez, a representative of the Democratic Center Party, said raising the income tax surcharge already paid by financial institutions -- including banks, insurers and brokerage firms -- 50% from 40% -- would lead to more expensive loans or less access to the formal credit market.

Bruce Mac Master, president of the National Business Association of Colombia (Andi), has warned of a domino effect from the reform. He said it could raise production and transportation costs, hurting the country's competitiveness.

"This reform will probably be the one that most affects Colombian families of all the projects presented in recent years," Mac Master told local media.

Opposition lawmakers in Congress have vowed to block the bill, underscoring the governing challenges facing Petro, who needs support from the economic committees for the reform to advance.

"The government presents this only to follow the same strategy as last year. It puts forward impossible proposals and then blames Congress because this has no chance of passing," Darío Pérez said.

"Colombia has a long history of tax reforms, with more than 21 attempts since 1990 and at least 14 significant reforms since 2000," political analyst Mauricio Morris noted.

He added that each administration has pursued changes with different aims, from broadening the tax base to encouraging investment or confronting fiscal crises.